The Cascading Effect on the Market

A lot is happening in the market right now that may not be visible to the naked eye but it’s having a big impact here at home. Let’s break it down.

According to recent data from GasBuddy.com, the average fuel price continues to fall, sitting just under $3 a gallon. Lower fuel prices often lead to falling yields on 10-year bonds which currently sit around 3.957% as of October 22.

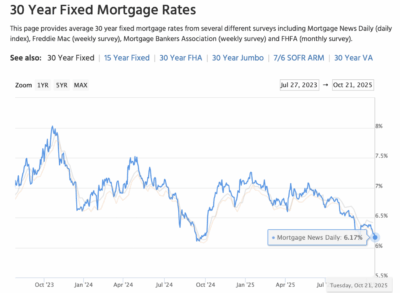

Here’s where the ripple effect begins: as bond yields fall, so do mortgage rates. From July 2023 to today, rates have fluctuated but have steadily declined since the summer of 2023, now averaging 6.17% for a 30-year fixed mortgage. We’re even seeing offerings as low as 4.875% for 7-year fixed financing (and still trending downward).

The ongoing federal government shutdown could further slow the broader economy, which would likely push interest rates even lower.

What Does This Mean for Buyers and Sellers?

If you’ve been waiting for the right time to make a move, now might be it.

The fall market typically brings motivated buyers eager to get settled before the holidays. Listings that are well-prepared and well-priced stand out giving our sellers a strategic edge.

And there’s more good news: home buyers are back.

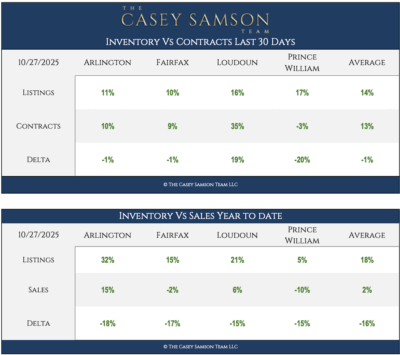

Inventory has seen modest gains compared to last year’s “dumpster fire” of supply, but buyer activity is catching up fast. This month, the number of new contracts matches the number of new listings, a clear sign that demand is returning and momentum is building. That’s great news for sellers heading into the final stretch of the year.

Markets are always moving but knowing how they move makes all the difference. As rates drop and buyers come back, having the right guidance can turn market shifts into opportunities.

Casey studies these trends every week to help our clients make smart, confident decisions. If you’re considering a move, strategy matters. The right pricing, timing, and preparation can make all the difference. Our team is here to help you make the most of it. Contact Casey today at 703-508-2535 or email [email protected].

The Casey Samson Team is a premier Northern Virginia real estate team known for unmatched market expertise, powerful negotiation skills, and exceptional client service. In 2024, our team achieved $208M in home sales, ranking as a top-producing team at the leading brokerage in the DMV real estate market.

Our Realtors are consistently recognized among the top agents in Vienna, Oakton, Haymarket, Aldie, Ashburn, and Leesburg, Virginia, helping buyers and sellers navigate today’s competitive market with confidence. Whether you’re looking to buy a home or sell a home in Northern Virginia, our team delivers proven results, local insight, and a client-first experience.