Understanding Real Estate Cycles:

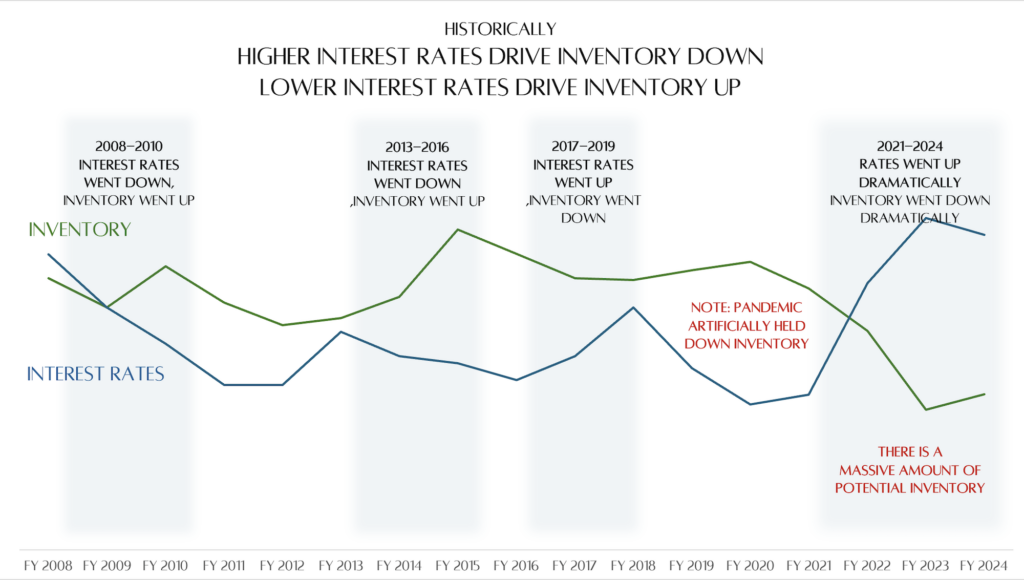

Interest Rates Drive Inventory.

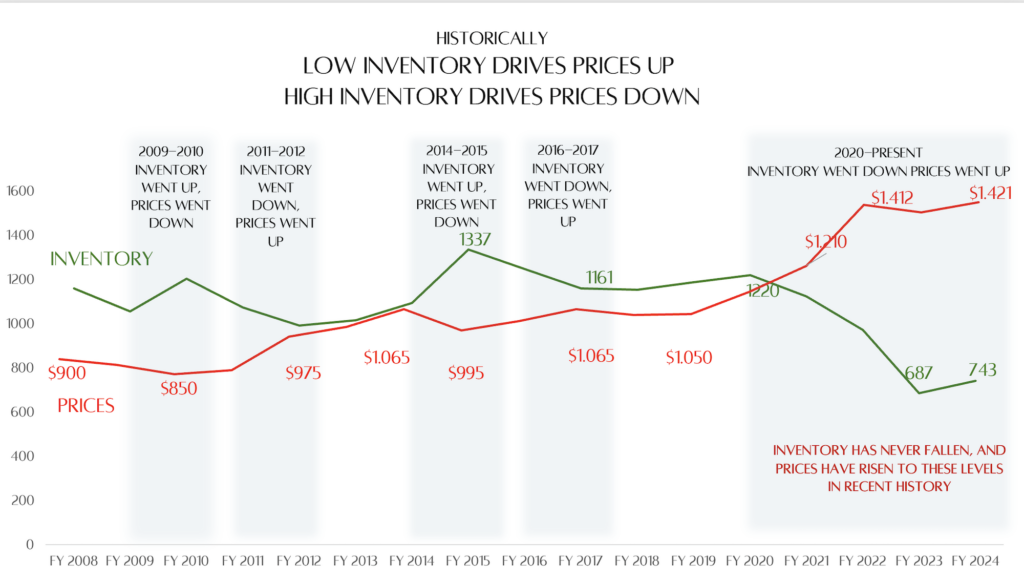

Inventory Drive Prices.

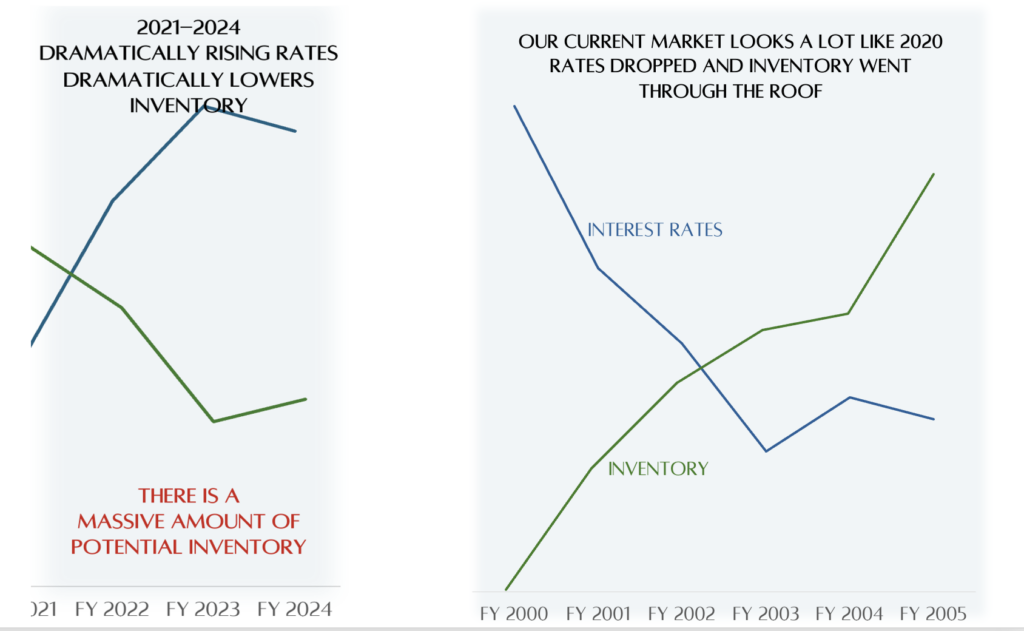

Here is proof on how interest rates drive inventory and inventory in turn impacts real estate prices. This chart shows that, historically, when interest rates drop like they are, inventory increases.

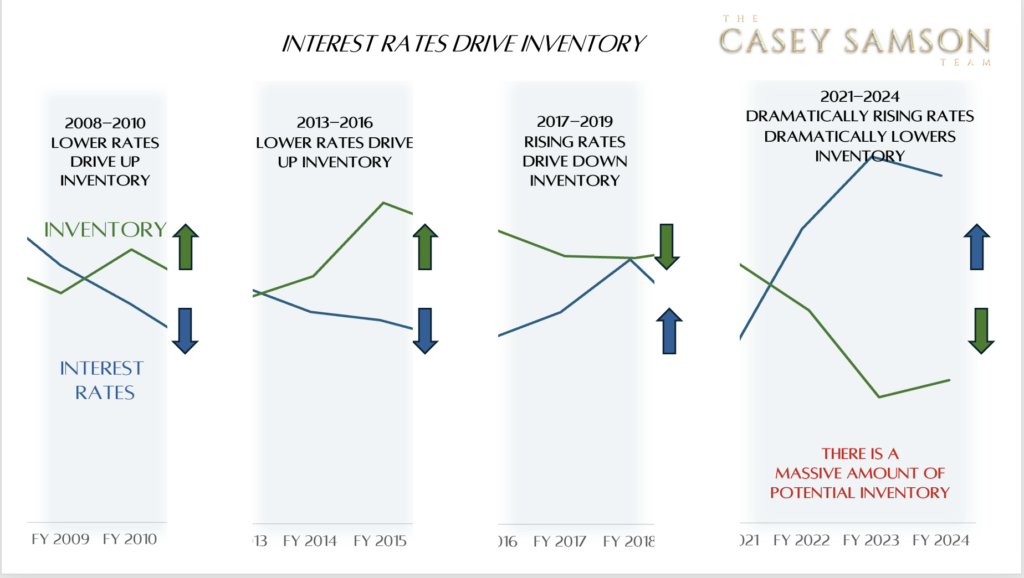

Here is s better look at it.

- When rates decrease, inventory increases

- When rates increase, inventory decreases

As Inventory increases, prices level off or go down.

- High inventory driving prices down

- Low inventory driving prices up

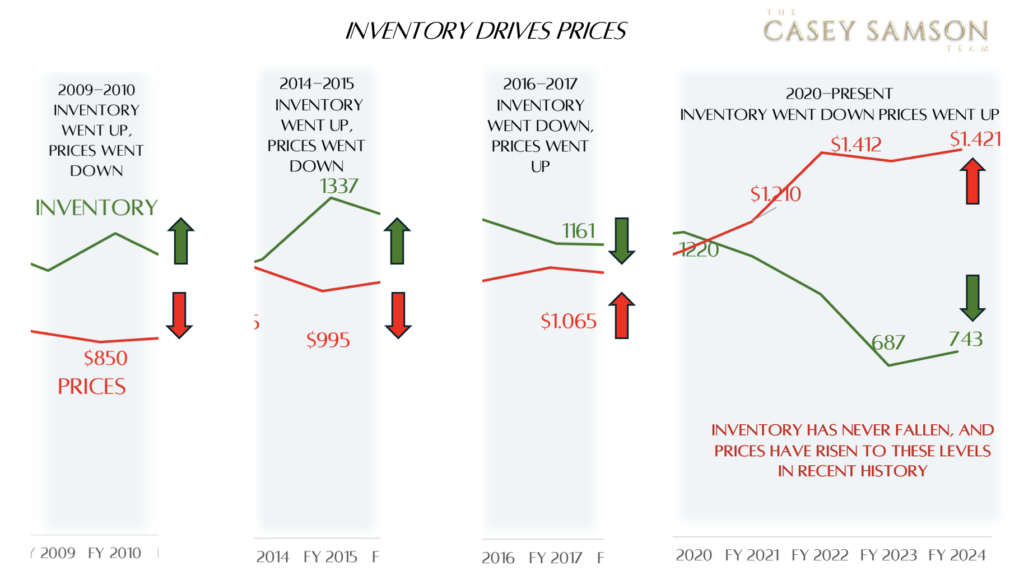

Here’s a closer look.

To see the future you need to look at the past.

Where are we in the cycle?

The current pricing is solid and inventory is low. There is no doubt about the value of +/- $1.1. The question is where we adjust the list price to get enough people in the home to bid. At $1.1, not enough people are coming to generate a bid.

Listen to this episode on our Podcast on Apple, Spotify, Amazon and more. Search “Pod of Coffee with Casey”

Article and charts by Casey Samson, do not copy without permission.